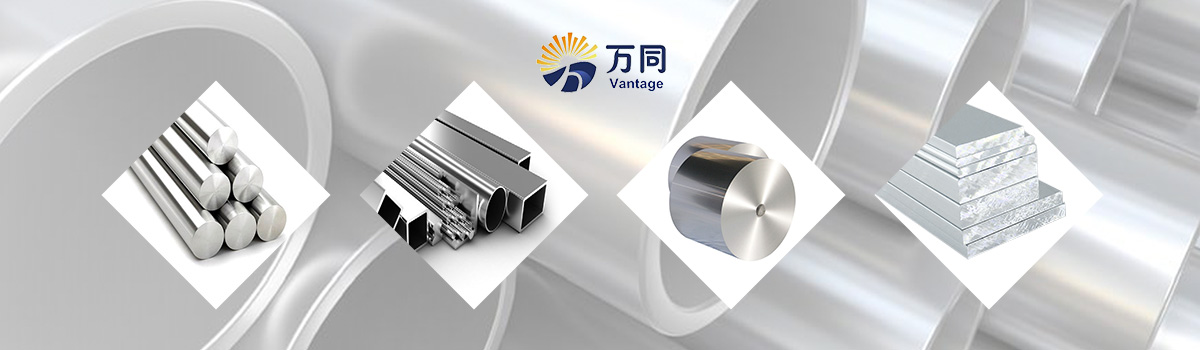

Since October 2018, external challenges have increased markedly. Structural adjustment pains have emerged. Economic downward pressure has increased, environmental restrictions are erratic, the futures market has surged upwards, short-term catch-up demand has increased sharply, building materials inventory has dropped sharply, steel mills'profits have increased continuously, the willingness to expand production has increased steadily, and the steel market has surged. By the end of October, the Langer Composite Price Index had closed at 169.9, up 1.13% year-on-year and 7.66% year-on-year (see Figure 1 for details). In November, the domestic steel market shook narrowly, the economy was stable and moderate, the real estate investment was stable, the manufacturing industry was under pressure, the capital construction was expected to recover, the mineral price was rising slightly, the output was maintained at a high level, the environmental protection and production restriction were implemented, and the steel market shook narrowly. It is expected that the Lange composite index will oscillate in a narrow range with a concussion interval of 165-175 and a target value of 168.

First, the economy is stable and moderate.

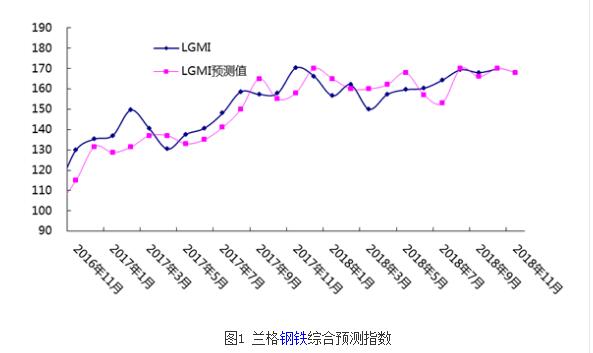

According to the monitoring data of Langer Iron and Steel Cloud Business Platform, the growth rate of fixed assets investment in January-September 2018 was 5.4%, which was 0.1 percentage point higher than that in January-August. In September 2018, M1 grew by 4%, an increase of 0.1 percentage points over August. In September 2018, the M2 growth rate was 8.29%, an increase of 0.08 percentage points over August. In 2018, RMB loans increased by 13 trillion and 140 billion yuan in 1-9 months, up by 1 trillion and 980 billion yuan compared with the previous year (see Figure 2).

In the first three quarters, the investment in fixed assets in China totaled 48344.42 billion yuan, up 5.4% year-on-year, a slight increase of 0.1 percentage points compared with January-August, ending the monthly decline since the beginning of this year and stabilizing investment growth.

Four major regional investment growth rates have stabilized. In the first three quarters, investment growth in the east, middle, West and northeast regions has stabilized. Among them, investment in the eastern region increased by 5.8% year-on-year, 0.1 percentage points higher than that in January-August; investment in the central region increased by 9.6% and 0.4 percentage points higher; investment in the western region increased by 2.3% and 0.1 percentage points higher than that in the Northeast region. Investment growth was 1.7%, the growth rate was unchanged from 1-8 months.

Manufacturing industry has become an important driving force for stimulating investment growth. In the first three quarters, China's manufacturing investment maintained a relatively rapid growth trend, increasing by 8.7% year-on-year, 1.2 percentage points higher than in January-August, 4.5 percentage points higher than in the same period last year, and 3.3 percentage points higher than the total investment. In the first three quarters, investment in high-tech manufacturing increased by 14.9%, 2 percentage points higher than that in January-August, 6.2 percentage points higher than that in all manufacturing industries; investment in technological transformation in manufacturing increased by 15.2%, 6.5 percentage points higher than that in all manufacturing industries.

Investment in ecological and environmental protection has increased rapidly. In the first three quarters, the investment in ecological protection and environmental treatment industry increased by 33.7% year on year. Among them, the investment in ecological protection industry increased by 52.8%, the investment in water pollution control industry increased by 30.9%, and the investment in solid waste treatment industry increased by 29.1%. In addition, investment in environmental monitoring special instrumentation manufacturing industry is also up to 45.8%.

Private investment continued to maintain rapid growth. In the first three quarters, private investment grew by 8.7% year-on-year, the growth rate was the same as in January-August, 2.7 percentage points higher than the same period last year, and 3.3 percentage points higher than the total investment. Among the private investment, the investment in agriculture, forestry, animal husbandry and fishery increased by 11.3%, the investment in manufacturing industry increased by 9.5%, and the investment in service industry increased by 9.1%.

Two, the price of mineral rose slightly.

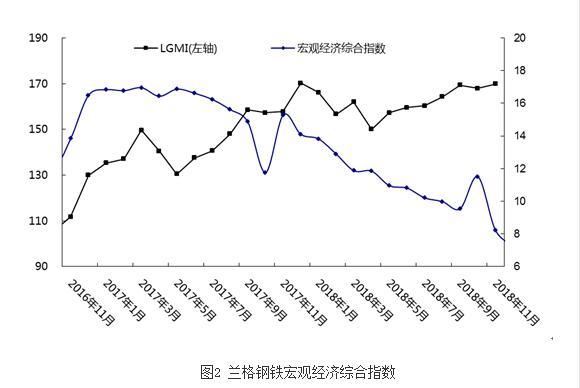

According to the monitoring data of Langer Iron and Steel Cloud Merchant Platform, the domestic iron concentrate in October 2018 was 745.66 yuan/ton, up 0.33 yuan/ton from September. In October 2018, domestic coke was 2443.75 yuan / ton, up 93.75 yuan / ton compared with September. According to customs data, the average import price in September 2018 was $70.49 per ton, up $2.89 per ton from August. In October 2018, the przewalskii 62% iron ore index was 72.69, an increase of 3.96 over September (see Figure 3). Iron ore prices have shown signs of rising recently. In November, iron ore prices will maintain a slight upward trend.

Three, real estate investment steady

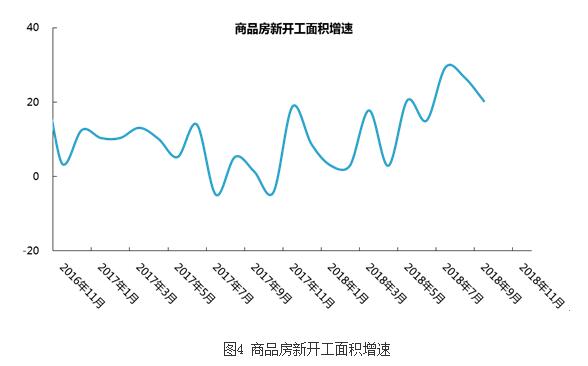

According to the monitoring data of Langer Iron and Steel Cloud Business Platform, in January-September 2018, the national real estate development investment was 8866.5 billion yuan, an increase of 9.9% compared with the same period last year, and the growth rate fell by 0.2 percentage points compared with January-August. Among them, residential investment 62806 billion yuan, an increase of 14%, the growth rate dropped 0.1 percentage points. The proportion of residential investment in real estate development investment is 70.8%. From January to September, the construction area of real estate development enterprises was 767.218 million square meters, an increase of 3.9% compared with the same period last year. The growth rate was 0.3 percentage points higher than that in January to August. Among them, the residential construction area of 5 billion 302 million 510 thousand square meters, an increase of 4.9%. The new housing area has increased by 1 billion 525 million 830 thousand square meters, an increase of 16.4%, and the growth rate has increased by 0.5 percentage points. Among them, the new residential area of 1 billion 124 million 110 thousand square meters, an increase of 19.4%. Housing completed area of 511 million 320 thousand square meters, down 11.4%, the decline narrowed by 0.2 percentage points. Among them, the completion of residential area of 361 million 660 thousand square meters, down 12.3%. From January to September, the land purchasing area of real estate development enterprises was 193.66 million square meters, an increase of 15.7% compared with the same period last year. The growth rate was 0.1 percentage points higher than that in January-August. The land transaction price was 100.2 billion yuan, an increase of 22.7%, and the growth rate dropped by 1 percentage point.

From January to September, the sales area of commercial housing was 1193.13 million square meters, up 2.9% year-on-year, and the growth rate dropped 1.1 percentage points from January to August. Among them, residential sales area increased by 3.3%, office sales area decreased by 9.3%, commercial sales area decreased by 1.1%. Commercial housing sales volume of 104132 billion yuan, an increase of 13.3%, the growth rate dropped 1.2 percentage points. Among them, residential sales increased by 15.6%, office sales decreased by 5.0%, and commercial sales increased by 3.0%. At the end of 9, the area of commercial housing for sale was 531 million 910 thousand square meters, which was 6 million 820 thousand square meters lower than that at the end of 8. Among them, the area for sale of residential buildings decreased by 437,000 square meters, office buildings by 260,000 square meters and commercial commercial houses by 172,000 square meters (see Figure 4 for details).

Four, infrastructure is expected to rebound.

According to the monitoring data of Langer Iron and Steel Cloud Business Platform, from January to September 2018, China's transportation fixed assets investment completed 2.28 trillion yuan, an increase of 1.4% compared with the same period last year. Highway and waterway investment reached 1.65 trillion yuan, an increase of 0.4% over the previous year, and 91.8% of the annual target of 1.8 trillion yuan. Among them, the investment in Expressway completion was 702.6 billion yuan, an increase of 12.0% over the same period of last year. The investment in provincial highway and rural highway completion was 471.7 billion yuan and 354.8 billion yuan, respectively, which decreased by 14.4% and 1.3% over the same period of last year. The investment in waterway construction completion was 81.2 billion yuan, a decrease of 7.9% over the same period of last year From January to September, China's railway fixed assets investment completed 57.2289 billion yuan, an increase of 4.9% over the same period last year; among them, the national railway fixed assets investment completed 54.6799 billion yuan, an increase of 5.08% over the same period last year.

At present, there are still many short boards in China's development, especially in the field of infrastructure, so making up for them has become an important measure to stabilize investment and steady growth. In the fourth quarter, investment in infrastructure began to accelerate. Recently, the National Development and Reform Commission (NDRC) has intensively approved a number of high-speed and ultra-high-voltage projects, involving a total investment of 100 billion yuan. On October 9, the National Development and Reform Commission approved the feasibility study report of the 300,000-ton waterway reconstruction and expansion project in Zhanjiang Port, and the total investment of the project was estimated at 3.866 billion yuan. On October 17, the National Development and Reform Commission officially approved the feasibility study report on the new Shanghai railway from Suzhou to Huzhou, with a total investment of 36.795 billion yuan. On October 25, the information released by Chongqing Development and Reform Commission showed that the National Development and Reform Commission recently officially approved the feasibility study report of Chongqing-Qianjiang section of Chongqing-Hunan high-speed railway, with a total investment of 53.5 billion yuan. At the same time, many local intercity rail transit projects have been approved by the local development and reform commission, and many provinces and municipalities have issued intensive medium and long-term traffic planning.

In October 31st, the general office of the State Council issued the guiding opinions on maintaining the strength of infrastructure in the field of infrastructure, and put forward a major strategy to support the "one belt and one way" construction, the coordinated development of Beijing, Tianjin and Hebei, the development of the Yangtze River economic belt, and the construction of the bay area of Guangdong, Hong Kong and Macao. Qi railway, highway, waterway, airport, water conservancy, energy, agriculture and countryside, ecological and environmental protection, public services, urban and rural infrastructure, shantytowns transformation and other fields have been short-boarded, and major projects that have been incorporated into the planning have been accelerated. At the same time, the Guiding Opinions also set out the key tasks in the nine fields. Among them, in the field of railways, with the central and western regions as the focus, we will accelerate the "eight vertical and eight horizontal" main passage project of high-speed railway, expand regional railway links and further improve the backbone railway network. Promote the planning and construction of inter-city railways in Beijing-Tianjin-Hebei, Yangtze River Delta, Guangdong-Hong Kong-Macao Dawan District, etc. In the field of airports, we will focus on the early stage of the construction, relocation and expansion of a number of international hub airports and regional airports in the central and Western regions, and strive to start construction as soon as possible. Next, the National Development and Reform Commission will set up a reserve bank for the short-cut board projects, which will be launched in batches in key areas of construction. Infrastructure investment is expected to rebound from the bottom.

Five, manufacturing industry under pressure

According to the monitoring data of Langer Steel Cloud Platform, the purchasing manager index (PMI) of China's manufacturing industry was 50.2% in October 2018, down 0.6 percentage points from last month. From the 13 sub index, compared with the previous month, in addition to production and business activities expected index is flat. The remaining 12 indices all declined. Among them, the production index, the new order index, the new export order index, the purchase price index and the ex-factory price index decreased by more than 1 percentage point, while the other indexes decreased by less than 1 percentage point. After September, the PMI index continued to decline significantly in October, indicating that the short-term downward pressure of the economy is still large. According to the index, it is expected that industrial production level will continue to decline in October, while domestic and foreign market demand level will decline and export growth rate will decline. Judging from the changes in purchasing volume and raw material inventory, the confidence of enterprises in the market is obviously insufficient. In addition, the price level of industrial products is expected to decrease. At the same time, we need to see that China's economic fundamentals have been significantly improved, and the policy of steady growth and stable expectations is more vigorous. On the whole, the economic downturn caused by short-term factors will not continue to develop. The economic situation will begin to improve at the end of the year and the beginning of the year.

The production index is 52%, down 1 percentage points from last month. The new order index was 50.8%, down 1.2 percentage points from last month. The new export orders index was 46.9%, down 1.1 percentage points from last month. The backlog order index was 44.3%, down 0.9 percentage points from last month. Finished goods inventory index was 47.1%, down 0.3 percentage points from last month. The purchasing volume index was 51%, down 0.5 percentage points from last month. The import index was 47.6%, down 0.9 percentage points from last month. The purchase price index was 58%, down 1.8 percentage points from last month. Ex factory price index was 52%, down 2.3 percentage points from last month. The stock index of raw materials was 47.2%, down 0.6 percentage points from last month. The supplier delivery time index was 49.5, down 0.2 percentage points from last month. Production and business activity expectations index was 56.4%, unchanged from last month.

Six, inventory continues to differentiate

In October 2018, domestic steel stocks continued to differentiate. According to the monitoring data of Lange Iron and Steel Cloud Merchant Platform, the domestic steel social inventory at the end of October 2018 was 8.466 million tons, up 0.01%, down 1.47% year-on-year; among them, 89.69 million tons of wire rod, down 11.75%, down 8.39% year-on-year; 3.09.76 million tons of thread, down 9.61% year-on-year, down 13.64% year-on-year; 213.67 million tons of hot rolling, ring. Compared with the previous year, it increased by 16.52% and 13.39%, cold-rolled 103.08 million tons, ring-to-ring ratio increased by 8.13% and 15.65% respectively, and medium plate 10.68 million tons, ring-to-ring ratio increased by 8.87% and 4.36% respectively.